Blockchain Technology

What is Fractional Ownership in Real Estate Investment with Blockchain

With the real estate market booming, starting property investments can be challenging and feel like trying to buy a castle with a piggy bank. But guess what? Thanks to the advancements in blockchain technology and tokenization, we can buy a fraction of the higher-cost properties using the concept of fractional ownership.

Blockchain is vital in democratizing and simplifying real estate investments through fractional ownership platforms using tokenization and smart contracts.

In this blog, we will explore how blockchain transforms fractional ownership in real estate and what benefits it brings to investors in enhancing their investment prospects.

What is Fractional Ownership?

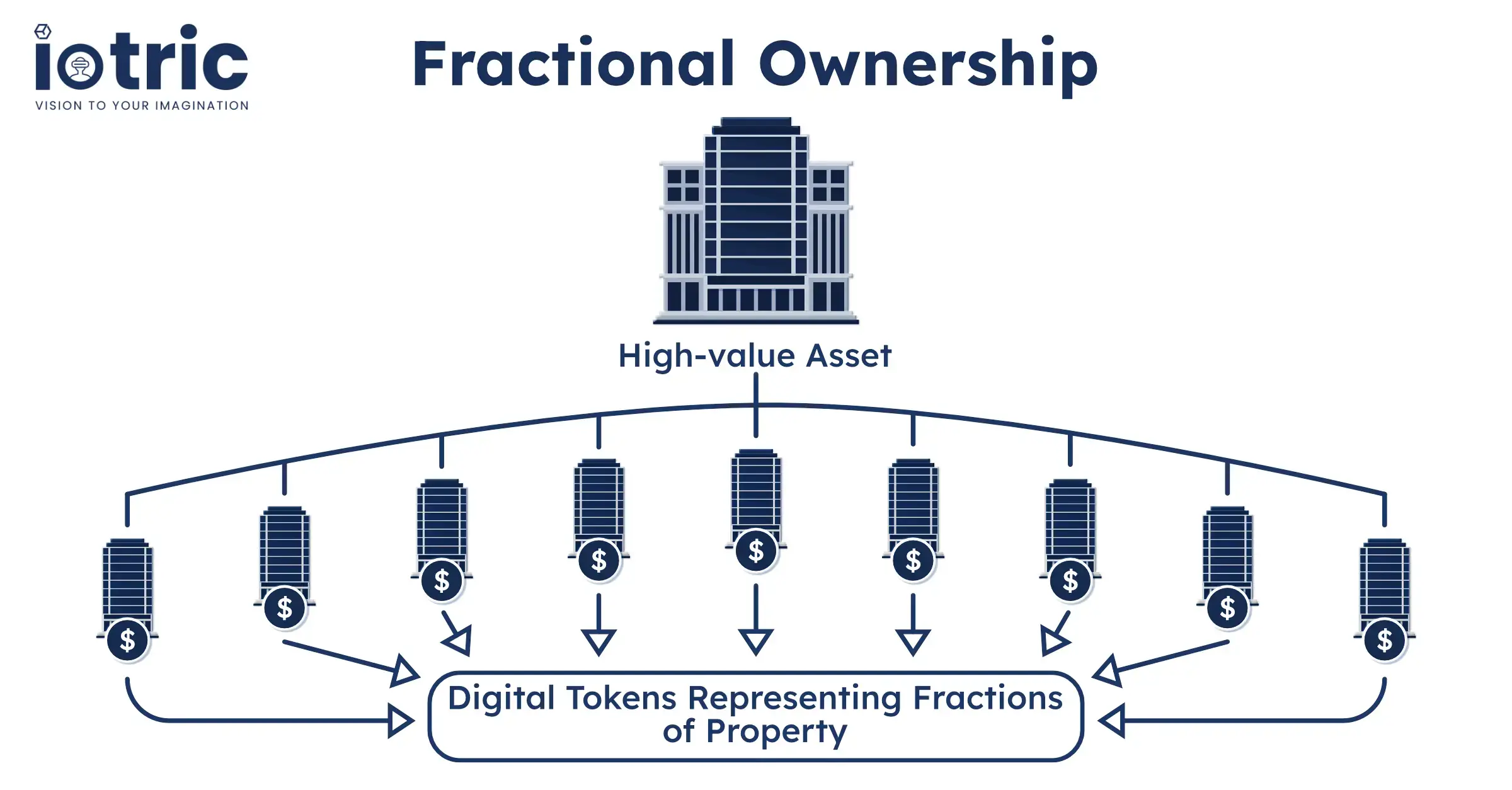

Fractional Ownership refers to breaking down higher-cost properties or assets, such as real estate and luxury items, into fractions or shares, allowing individuals to own a fraction of a particular high-value property instead of buying it entirely.

It became the game changer in the real estate industry, making it more accessible than ever for everyone with lower capital and higher liquidity in the market. This allows people to invest in high-value assets without needing significant capital.

Fractional ownership is commonly seen in:

- Real Estate: Investors own shares of rental properties and earn proportional returns.

- Luxury Goods: Shared ownership of private jets, yachts, and collectibles.

- Digital Assets: Tokenized ownership of NFTs, digital art, and intellectual property.

So, individual investors can diversify their portfolios by acquiring fractional ownership of different high-value properties while minimizing risk and increasing potential returns.

How Does Fractional Ownership Work?

The concept of fractional ownership is a multi-step process that requires strategic planning to execute smoothly, from asset acquisition to breaking it down into multiple shares and more.

Fractional ownership in the real estate process typically involves the following steps:

- Asset Acquisition: identifying a high-value asset that is legally structured for fractional ownership.

- Division into Shares: Property is then divided into multiple shares or tokens, each representing a percentage of ownership.

- Investor Participation: Individuals can purchase shares, gaining proportional rights to the asset’s profits and appreciation.

- Revenue Distribution: Investors earn returns based on their shares, such as rental income or asset appreciation.

- Exit Strategies: Investors can sell their shares in the secondary market or during a buyout event.

While traditional ownership involves paperwork such as agreement, cost-sharing modalities, and management responsibilities, that’s where blockchain-powered fraction ownership platforms came into existence.

Role of Blockchain in Fractional Ownership

Blockchain-powered fractional ownership emerged to replace traditional fractional ownership by democratizing and simplifying purchasing and selling fractions of high-value properties without requiring time-consuming paperwork.

Blockchain fractional ownership is called tokenization, which involves breaking down high-value properties into smaller fractions known as digital tokens on a blockchain network.

Behind the scenes, smart contracts and blockchain’s immutable records keep everything in place, providing a decentralized, secure, and transparent system for managing asset shares.

Each digital token corresponds to a specific fraction of the property value, which enables individuals to buy, sell, and trade property ownership like securities.

Tokenization offers advantages such as fast settlement, no paperwork, lower cost, and better risk management while lowering entry barriers such as high cost, time-consuming paperwork, and property analysis.

How Tokenization Works?

Tokenization converts high-value property into fractions representing digital tokens on a blockchain. The blockchain network is used to store all ownership records securely and permanently.

The tokenization process involves several steps:

- Asset Digitization: This step involves identifying high-value properties and creating digital tokens representing fractional ownership in them.

- Blockchain Recording: All the created tokens are recorded securely on the blockchain, and each token signifies a portion of the asset’s value.

- Distribution: Distributing digital tokens to investors or buyers is an essential step that can be done using blockchain platforms or initial coin offerings (ICO).

- Marketplace Listing: Digital tokens can be traded (bought and sold) on various blockchain exchanges, providing liquidity and allowing fractional ownership of assets.

The blockchain-based platform primarily manages the entire tokenization process, providing easier access, greater liquidity, and increased transparency for asset ownership and trading.

Benefits of Fractional Ownership in Real Estate

Easy Investing for Everyone in Real Estate

Fractional ownership simplifies investing in high-value assets. With a lower entry barrier, anyone can participate in these markets and purchase and sell fractional shares of high-value assets.

Novice investors and investors with lower capital can also take advantage of fractional ownership to invest in real estate, which broadens the opportunity for everyone.

No Boundaries for Investors

Buying and selling digital tokens (assets) can be done anywhere in the world using blockchain-based platforms, which remove the traditional real estate constrained by borders.

Fractional ownership is increasing the number of investors worldwide by making it easier to access and invest in assets located in different countries or regions.

Effortless Buying and Selling

The traditional buying & selling process of real estate property is time-consuming and costly. However, blockchain fractional ownership has simplified the process with liquidity to these markets.

Blockchain fractional ownership allows investors to trade their fractional shares or digital tokens seamlessly using blockchain exchanges, providing greater liquidity and flexibility.

Spreading Your Investments

With fractional ownership, you don’t have to invest a lot of capital in a single property, which poses a lot of risk in terms of risk management.

You can diversify your portfolio by investing small amounts in multiple assets by purchasing digital tokens, which significantly reduces risk and increases profitability in the long run.

High Security to Your Assets

Traditional property ownership carries a higher risk of fraud and malicious activity, which can sometimes lead to loss of property ownership due to malicious manipulation of government data.

However, blockchain provides security and transparency for fractional ownership, significantly reducing the fear of losing funds due to fraud or malicious activities.

Challenges & Risks of Fractional Ownership

Fractional ownership in real estate has opened new doors for investors by making high-value assets more accessible. However, like any investment model, it comes with challenges and risks that need careful consideration.

1. Regulatory Uncertainty

One of the biggest challenges of fractional ownership, especially when combined with blockchain technology, is the lack of clear regulations in many countries. While some countries are still developing their legal frameworks for blockchain-based assets, others have already established regulations. Some key regulatory risks include:

- Lack of standardization: Different countries have different laws regarding digital assets and property ownership.

- Changing policies: Governments and financial authorities frequently update laws, which may affect existing investments.

- Compliance challenges: Tokenized assets may need to comply with securities laws, making it difficult for small investors to participate without legal complexity.

However, the differences between these legal systems make the investment process more complex for investors, as they must understand varying laws.

2. Market Volatility and Asset Valuation

The value of fractionalized assets can be highly volatile, particularly when tokenized on a blockchain. Market fluctuations can also influence the value of tokenized real estate.

Additionally, while tokenization simplifies real estate investment and makes trading easier, it also has drawbacks. High trading activity can lead to price speculation rather than actual demand-driven growth.

Moreover, fractional ownership in real estate is still an emerging technology that requires more regulations and standardized valuation methods. Currently, there is no clear way to evaluate tokenized assets, leading to uncertainty and confusion among investors, where even minor negative news can cause market instability.

3. Liquidity Concerns & No Proper Exit Strategy

Liquidity is one of the main benefits that tokenization offers to real estate by opening doors for investors with low capital. However, it also comes with challenges, such as difficulty in selling shares, especially in niche asset markets. Tokenized real estate is still not as liquid as stocks or cryptocurrencies.

Unlike publicly traded stocks, fractional ownership shares may not always have a structured resale process, which can create problems for investors who want to sell their shares quickly.

To manage liquidity risks, investors should choose platforms with active secondary markets where shares can be easily traded.

4. Security Risks and Fraud

Traditional property investments are always vulnerable to fraudulent activities, as many fraudsters try to deceive people by selling properties with fake documents. However, while fractional ownership reduces some risks, it also introduces new threats and scams.

For example, if a smart contract has coding flaws, hackers can exploit them to steal funds. Additionally, some companies may falsely claim ownership of assets and issue fake tokens.

To stay safe, investors should only use trusted, audited platforms and conduct due diligence before purchasing fractional shares.

Future of Fraction Ownership in Real Estate Investment

With the advancements in blockchain technology and the birth of tokenization, the future of real estate investment continues to grow with this innovative approach, offering opportunities for investors, developers, and professionals alike.

As real estate tokenization continues to gain traction, it promises to revolutionize real estate investing by providing accessibility, liquidity transparency, and more security than ever before.

The simplification of real estate investment through fractional ownership and low entry barriers are the key drivers for the future growth of real estate tokenization, which will attract more institutional and retail investors.

Conclusion

Blockchain fractional ownership is overcoming the limitations of traditional asset buying and selling while providing easy investment access, liquidity, diversification, and security to everyone around the world.

With fractional ownership, you don’t need huge capital to invest in high-value assets. Still, you can buy a fraction of a stake in a particular asset at a low cost, significantly increasing the number of investors.